Becoming a personal loans broker can be a lucrative career path for those with a knack for finance and a passion for helping individuals and businesses secure the funding they need.

I will outline the steps required to embark on this rewarding journey and establish yourself as a successful personal loans broker.

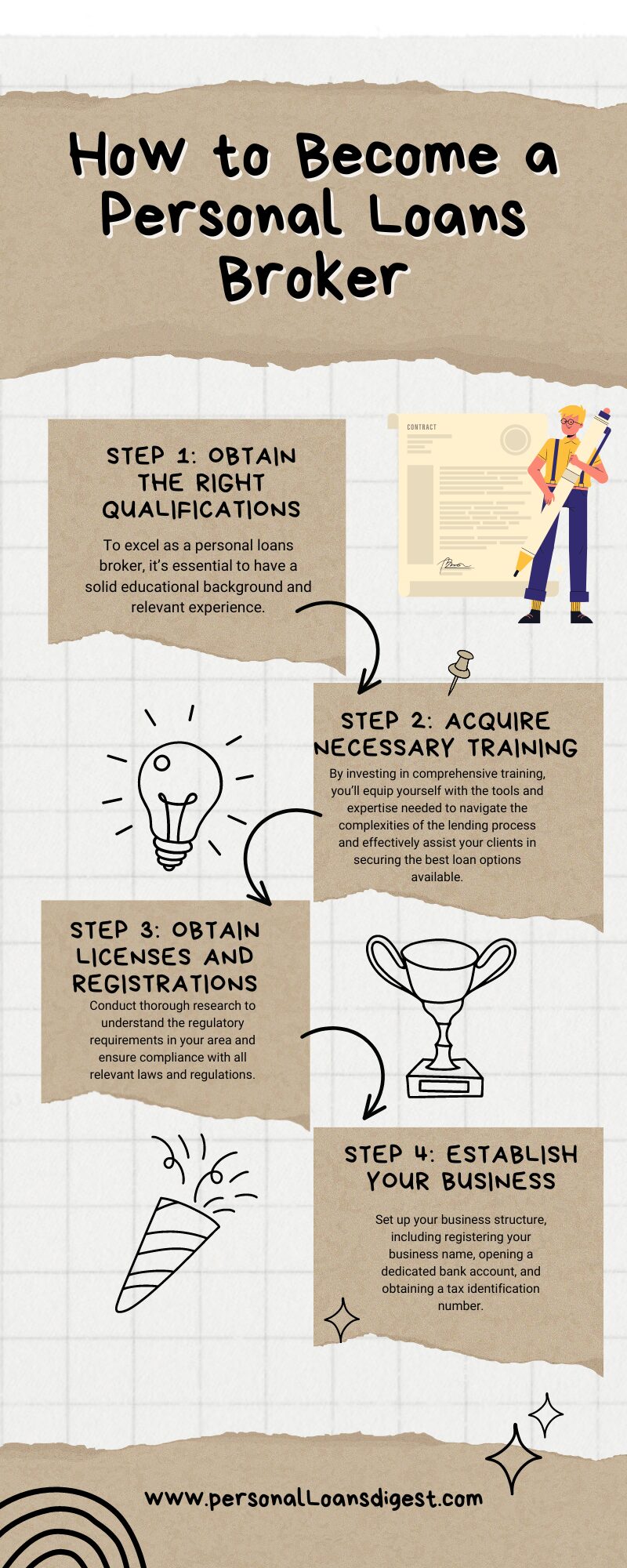

Step 1: Obtain the Right Qualifications

To excel as a personal loans broker, it’s essential to have a solid educational background and relevant experience.

Start by obtaining a high school diploma or GED, followed by a bachelor’s degree in finance, business administration, or economics.

While a degree is not always mandatory, it can significantly enhance your credibility and marketability in the industry.

Additionally, gaining experience in banking, sales, lending, or customer service can provide invaluable insights into the financial landscape and enhance your ability to understand and meet the needs of your clients.

Step 2: Acquire Necessary Training

To hone your skills and knowledge in loan brokering, consider enrolling in a reputable training program offered by a brokerage firm or an online course specializing in loan brokering fundamentals.

These programs typically cover essential topics such as client evaluation, lender identification, negotiation tactics, and paperwork completion.

By investing in comprehensive training, you’ll equip yourself with the tools and expertise needed to navigate the complexities of the lending process and effectively assist your clients in securing the best loan options available.

Step 3: Obtain Licenses and Registrations

Depending on your jurisdiction, you may be required to obtain specific licenses or registrations to operate as a personal loans broker legally.

Conduct thorough research to understand the regulatory requirements in your area and ensure compliance with all relevant laws and regulations.

This may involve passing background checks, paying licensing fees, and adhering to ethical and professional standards set forth by regulatory authorities.

By obtaining the necessary licenses and registrations, you’ll demonstrate your commitment to professionalism and uphold the trust of your clients.

Step 4: Establish Your Business

Once you’ve acquired the requisite qualifications, training, and licenses, it’s time to launch your personal loans brokerage business.

Decide whether you’ll operate independently or affiliate with a brokerage firm, weighing the pros and cons of each option based on your goals and resources.

Set up your business structure, including registering your business name, opening a dedicated bank account, and obtaining a tax identification number.

Define your rates and fees, develop a robust marketing strategy, and build a solid client base through networking and referrals.

Benefits of Joining Professional Associations

Joining professional associations such as the MFAA (Mortgage & Finance Association of Australia) can offer numerous benefits for personal loans brokers.

These associations provide access to valuable resources, ongoing support, and networking opportunities within the industry.

Become a member of reputable professional associations. You’ll consequently stay abreast of industry trends.

Additionally, you will gain access to training and educational programs.

Therefore, your credibility as a trusted advisor in the field of loan brokering is enhanced.

In conclusion, embarking on a career as a personal loans broker offers the opportunity for financial success and personal fulfillment.

By following these steps and investing in your education, training, and professional development, you can position yourself for long-term success in this dynamic and rewarding industry.

Success as a personal loans broker requires dedication, hard work, and commitment to delivering exceptional service to your clients.

By leveraging your expertise and resources effectively, you can help individuals and businesses navigate the lending landscape. As a result, they achieve their financial goals.

Now, it’s your turn to take the first step towards becoming a successful personal loans broker. If you’re ready to embark on this exciting journey, don’t hesitate to reach out.