In this guide, I will explore the possibilities, procedures, and precautions involved in student loans transfers.

When it comes to student loans, the question of transferring debt from one individual to another is a topic that often surfaces.

Whether it’s parents considering the transfer of a loan to their child or a spouse looking to take on their partner’s debt, understanding the intricacies of this process is crucial.

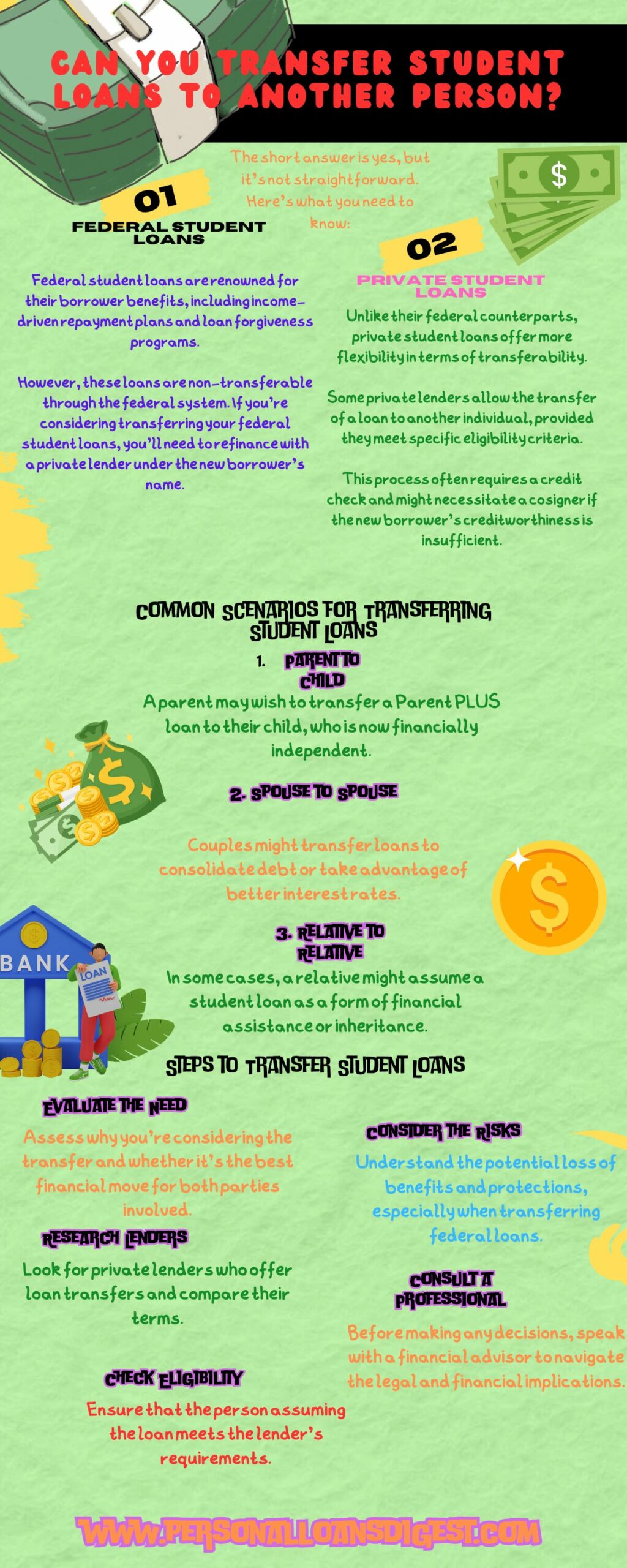

Can You Transfer Student Loans to Another Person?

The short answer is yes, but it’s not straightforward. Here’s what you need to know:

Federal Student Loans

Federal student loans are renowned for their borrower benefits, including income-driven repayment plans and loan forgiveness programs.

However, these loans are non-transferable through the federal system. If you’re considering transferring your federal student loans, you’ll need to refinance with a private lender under the new borrower’s name.

This action, though, comes with a significant caveat: the loss of all federal loan benefits.

Private Student Loans

Unlike their federal counterparts, private student loans offer more flexibility in terms of transferability.

Some private lenders allow the transfer of a loan to another individual, provided they meet specific eligibility criteria.

This process often requires a credit check and might necessitate a cosigner if the new borrower’s creditworthiness is insufficient.

Common Scenarios for Transferring Student Loans

Some of the common student loans transfers scenarios include:

Parent to Child

A parent may wish to transfer a Parent PLUS loan to their child, who is now financially independent.

Spouse to Spouse

Couples might transfer loans to consolidate debt or take advantage of better interest rates.

Relative to Relative

In some cases, a relative might assume a student loan as a form of financial assistance or inheritance.

Steps to Transfer Student Loans

Here are the steps taken during loan transfers:

Evaluate the Need

Assess why you’re considering the transfer and whether it’s the best financial move for both parties involved.

Research Lenders

Look for private lenders who offer loan transfers and compare their terms.

Check Eligibility

Ensure that the person assuming the loan meets the lender’s requirements.

Consider the Risks

Understand the potential loss of benefits and protections, especially when transferring federal loans.

Consult a Professional

Before making any decisions, speak with a financial advisor to navigate the legal and financial implications.

Transferring student loans is a decision that should not be taken lightly. It requires careful consideration of the financial impact, the loss of benefits, and the legal responsibilities that come with a new loan agreement.

By following this guide, borrowers and potential new loan holders can make informed decisions that align with their financial goals.