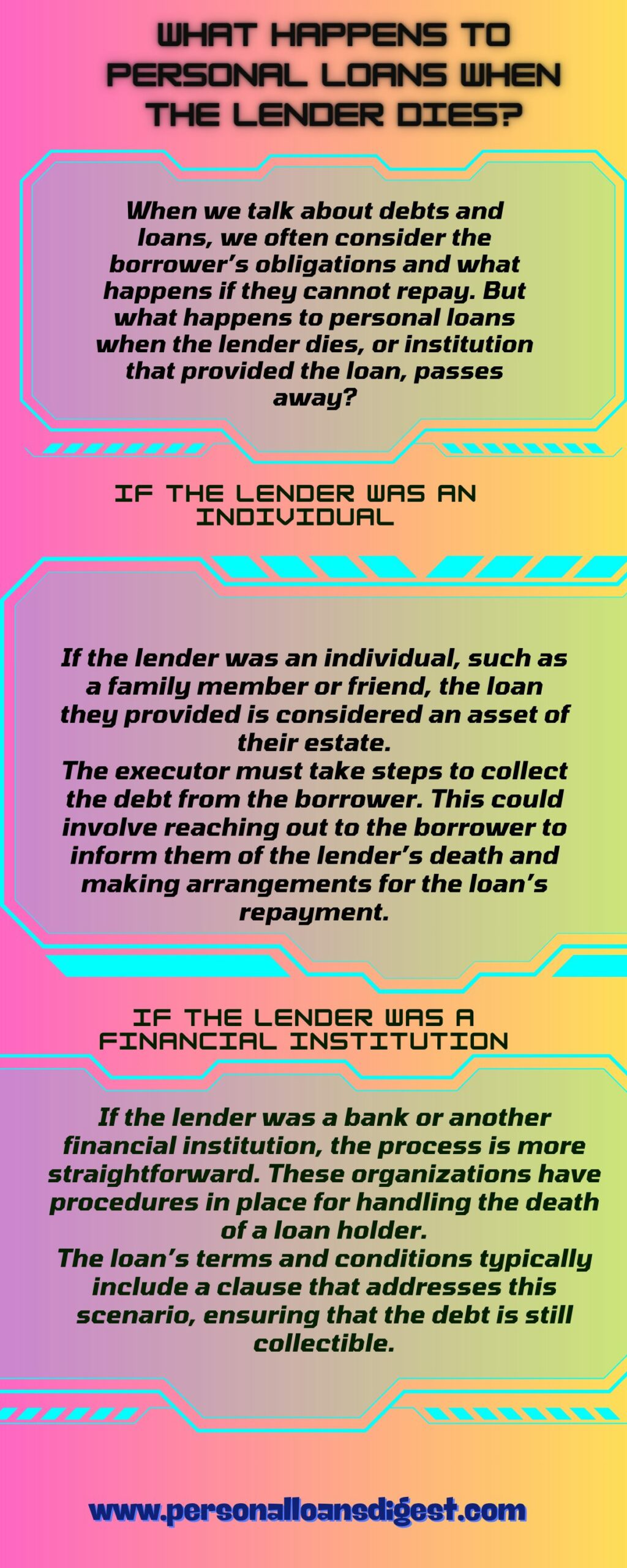

When we talk about debts and loans, we often consider the borrower’s obligations and what happens if they cannot repay. But what happens to personal loans when the lender dies, or institution that provided the loan, passes away?

This is a question that doesn’t come up often, but it’s an important scenario to consider, especially for personal loans where the lender may be an individual rather than a financial institution.

Understanding Personal Loans

Personal loans are typically unsecured loans provided by a lender to a borrower for personal use. Unlike secured loans, they do not require collateral, such as a house or car, to back them up.

This means that if the borrower defaults, the lender cannot automatically take possession of any property to recover their funds.

Personal loans can be obtained from banks, credit unions, online lenders, or even friends and family.

The Legal Framework

When a lender dies, the loan they provided becomes part of their estate. The responsibility for managing the estate, including any outstanding loans, falls to the executor or administrator.

This person is appointed by the court or named in the deceased’s will. Their role is to settle the estate, which includes collecting any debts owed to the deceased.

If the Lender Was an Individual

If the lender was an individual, such as a family member or friend, the loan they provided is considered an asset of their estate.

The executor must take steps to collect the debt from the borrower. This could involve reaching out to the borrower to inform them of the lender’s death and making arrangements for the loan’s repayment.

If the Lender Was a Financial Institution

If the lender was a bank or another financial institution, the process is more straightforward. These organizations have procedures in place for handling the death of a loan holder.

The loan’s terms and conditions typically include a clause that addresses this scenario, ensuring that the debt is still collectible.

Borrower’s Obligations

The borrower’s obligation to repay the loan does not change because the lender has died. They are still legally required to continue making payments according to the loan agreement.

If the borrower fails to make payments, the executor has the right to take legal action to recover the debt, just as the lender would have during their lifetime.

Communication Is Key

It’s essential for the borrower to maintain open communication with the executor or the financial institution managing the deceased’s estate.

This can help ensure that payments are made to the correct party and that any necessary adjustments to the payment schedule are made.

Special Considerations

There are a few special considerations that may affect the repayment of a personal loan if the lender dies:

Joint Loans

If the loan was made jointly with another individual who is still alive, that person may now be solely responsible for the debt.

Insurance

Some loans come with insurance policies that pay off the debt if the lender dies. Borrowers should check the loan agreement to see if such a policy is in place.

State Laws

The laws governing the collection of debts after the lender’s death can vary by state. It’s important to consult with a legal professional to understand the specific laws that apply.

In conclusion, the death of a lender does not absolve the borrower from their responsibility to repay a personal loan.

The debt becomes part of the lender’s estate and must be managed by the executor. Therefore, borrowers should continue to make payments and communicate with the executor or financial institution to ensure that the loan is repaid according to the agreement.

Remember, the specifics can vary depending on the terms of the loan and state laws, so seeking legal advice is always recommended to navigate these situations.